Investing in Film: A Resilient Industry with Unmatched Global Potential

THE UK FILM SECTOR HAS PROVEN ITS RESILIENCE, CONTINUING TO GENERATE STRONG REVENUE EVEN DURING FINANCIAL CRISES WHEN MANY OTHER INDUSTRIES STRUGGLED. IN 2021, DESPITE MONTHS OF CLOSURE, UK CINEMAS SAW 74 MILLION ADMISSIONS AND £602 MILLION IN BOX OFFICE REVENUE, SHOWCASING THE INDUSTRY’S STRENGTH AND RECOVERY.

THE DEMAND FOR TV AND FILM CONTENT IS GLOBAL AND INSATIABLE. WITH THE RISE OF STREAMING PLATFORMS, TRADITIONAL TV CHANNELS, AND CINEMA, THERE IS A CONSTANT NEED FOR FRESH CONTENT. THIS WORLDWIDE APPETITE FOR ENTERTAINMENT ENSURES THAT FILM PRODUCERS CAN REACH A BROAD AUDIENCE AND BENEFIT FROM LUCRATIVE DISTRIBUTION DEALS.

MULTIPLE REPEAT SOURCES OF INCOME CAN GENERATE PROFITS FOR MANY YEARS, MAKING FILM INVESTMENT ONE OF THE MOST REWARDING AND SUSTAINABLE OPTIONS FOR INVESTORS.

INVESTORS ARE INCREASINGLY TURNING TO FILM AS A LUCRATIVE INVESTMENT OPPORTUNITY, ATTRACTED BY ITS POTENTIAL FOR PASSIVE INCOME, STABILITY, AND THE UNIQUE THRILL OF BEING INVOLVED IN THE DYNAMIC ENTERTAINMENT INDUSTRY.

Investing in Film: A Resilient Industry with Unmatched Global Potential

The UK film sector stands as a beacon of resilience and innovation — consistently delivering strong returns even when other industries falter. In 2021, after months of pandemic-induced closures, UK cinemas still recorded 74 million admissions and £602 million in box office revenue. These figures underscore not only the industry’s robustness but its ability to rebound faster and stronger than most.

What drives this resilience? A global, insatiable appetite for content.

From streaming platforms to traditional broadcasters and theatrical releases, the demand for compelling storytelling has never been greater. Audiences across the world are consuming more content than ever, creating a constant need for new films and series. This worldwide hunger presents filmmakers — and their backers — with vast opportunities for exposure, scalability, and high-margin distribution deals.

For investors, film offers more than just glamour. It offers multiple long-term revenue streams — from box office returns and streaming royalties to international licensing and merchandising. A single successful project can generate income for decades, making it one of the few investment vehicles capable of combining creative impact with sustainable financial performance.

It’s no surprise that a growing number of savvy investors are turning to the film industry — not only for the potential passive income and portfolio diversification but for the excitement of being part of a dynamic, influential, and culturally powerful global sector.

Film is no longer just entertainment. It’s a smart, forward-looking investment in a world hungry for stories.

Exclusive Partnership

Financial Expertise & Creative Vision

Showcase Investments Limited is proud to announce an exclusive partnership with M and M Film Productions Limited, becoming the sole fundraising and investment arm for all upcoming film and TV projects. This strategic alliance merges financial expertise with creative vision, offering investors a unique opportunity to be part of premium, globally resonant entertainment with strong return potential.

Equity-Based Film Investment

Own a Piece of the Action

That means for the entire lifespan of the film (which can be years, even decades), you’re entitled to your share of the profits — from box office, streaming, licensing, merchandising, and more.

- Real ownership

- Long-term earning potential

- A legacy in entertainment

Film Investment

Step Into The World Of Film – And Profit From It

A SMARTER, SAFER WAY TO INVEST

- 100% risk-mitigated structure

- Earn 25% ROI + lifetime royalties

- Potential to triple your capital in just 18 months

- Reinvest & repeat – multiply your returns

10 reasons

10 Irresistible Reasons To Invest In Film

100% Risk-Free?

Four layers of protection + a legally binding contract = unmatched investment security.

Fast & Big Returns

Earn 125% ROC - often in under 12 months.

Royalties for Life

Average annual payouts of 30% of your initial investment—for life.

Experience the Glamour

Visit sets, meet stars, attend red carpets & global festivals.

Investing Just Got Sexy

Move beyond boring portfolios—film is vibrant, exciting, and rewarding.

Sky-High Demand

Streaming giants are desperate for content—great for long-term growth.

Multiply Your Money

Reinvest returns into more productions. More films = more royalties = more wealth.

Ditch the 9-to-5

Build passive income that can replace your salary.

Buy Back Your Time

Enjoy freedom, flexibility, and a lifestyle upgrade.

Make Money. Have Fun. Repeat.

Earn reliable returns while enjoying the glitz and glamour.

10 reasons

10 Irresistible Reasons To Invest In Film

100% Risk-Free?

Four layers of protection + a legally binding contract = unmatched investment security.

Fast & Big Returns

Earn 125% ROC in under 12 months.

Royalties for Life

Average annual payouts of 30% of your initial investment—for life.

Experience the Glamour

Visit sets, meet stars, attend red carpets & global festivals.

Investing Just Got Sexy

Move beyond boring portfolios—film is vibrant, exciting, and rewarding.

Sky-High Demand

Streaming giants are desperate for content—great for long-term growth.

Multiply Your Money

Reinvest returns into more productions. More films = more royalties = more wealth.

Ditch the 9-to-5

Build passive income that can replace your salary.

Buy Back Your Time

Enjoy freedom, flexibility, and a lifestyle upgrade.

Make Money. Have Fun. Repeat.

Earn reliable returns while enjoying the glitz and glamour.

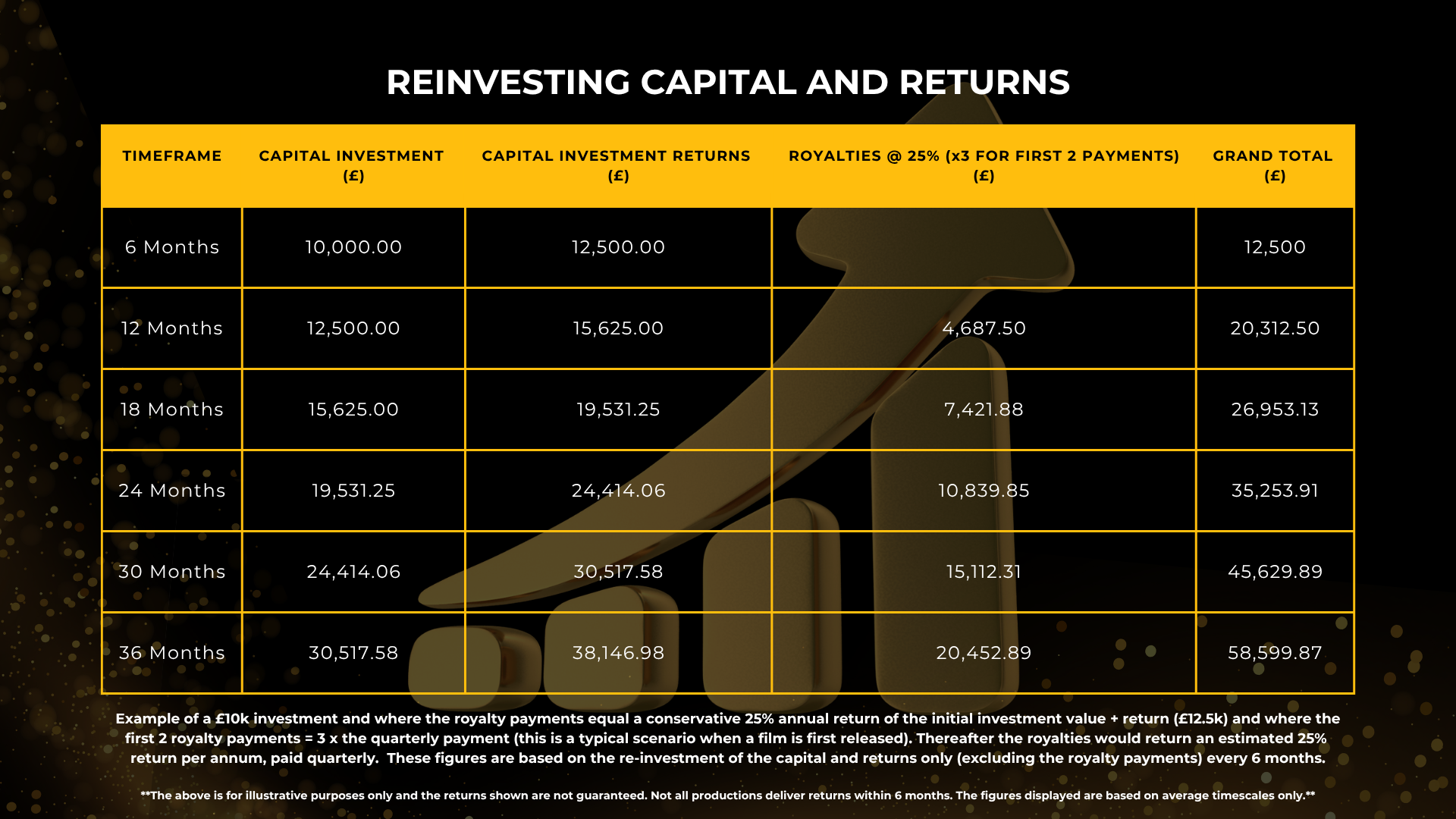

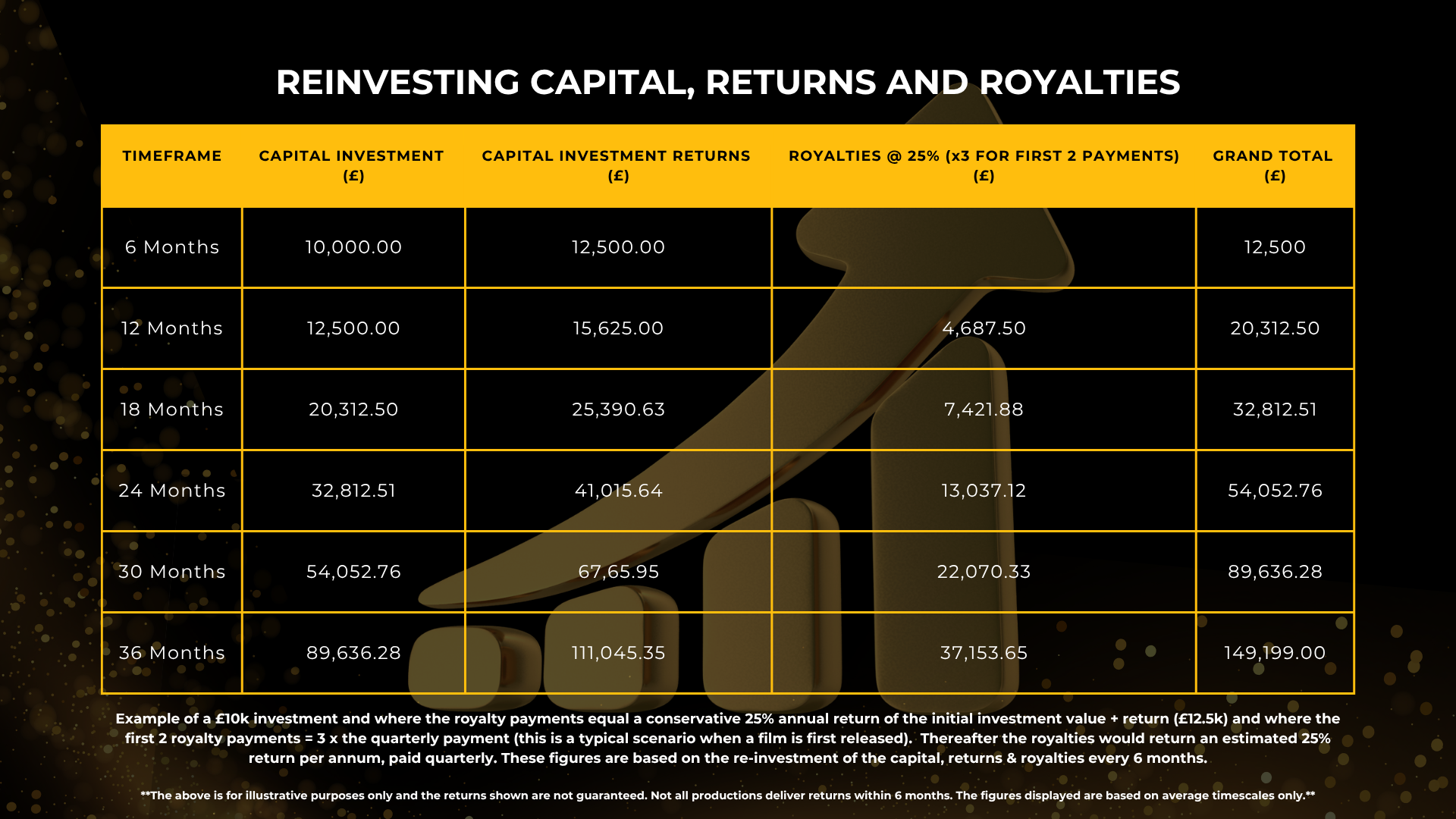

Reinvesting Capital And Returns

Reinvesting Capital, Returns And Royalties

Investor Journey

Investor Journey

What Are The Risks?

ALL INVESTOR FUNDS ARE PROTECTED IN 4 WAYS:

The security and protection of investor funds is a top priority for our production partners.

In an industry where trust and long-term relationships are everything, safeguarding the interests of our investors isn’t just a commitment — it’s a necessity. Our production partners understand that without the support of a strong investor community, along with valuable referrals and repeat business, the ability to consistently develop and deliver high-quality films and television content would not be possible.

That’s why every project is structured with transparency, accountability, and investor confidence in mind. From robust legal frameworks and insurance protections to collections agencies and secure SPV structures, every measure is taken to ensure that investor capital is not only respected but diligently protected.

Investors aren’t just contributors — they’re stakeholders in the creative journey. And our production partners are dedicated to ensuring their trust is continually earned, project after project.

Legally Binding Investor Protection Clause

In the highly unlikely event that an investor does not recoup their original investment following the release of the film, a legally binding clause ensures their capital is safeguarded.

Under this agreement, the full value of the initial investment will be automatically transferred — at no additional cost to the investor — into a new production. This process continues until the original investment has been fully recovered along with an additional 25% return.

This contractual obligation provides a powerful layer of security and confidence, reinforcing our commitment to delivering not just creative success, but financial results for every investor.

Special Purpose Vehicles (SPVs) are independent legal entities

Segregating Risk

Enhancing Transparency

Streamlining Investment

Facilitating Tax and Insurance Structuring

In short, SPVs bring order, accountability, and confidence to film financing — ensuring each project is financed, managed, and reported on as a self‐contained venture.

All productions are fully insured through Tysers

All productions are fully insured through Tysers, one of the most respected and long-established providers of entertainment-specific insurance worldwide. This comprehensive coverage is designed specifically for the film and television industry, safeguarding every aspect of the production process.

For investors, this means a critical layer of protection is in place. From unforeseen delays to major disruptions, the insurance policy ensures that your capital is secure — no matter what challenges may arise during production.

In the unlikely event that a film is halted or cancelled, investors are entitled to a full refund. This gives you the confidence of knowing that your investment is not only well-managed, but fully protected from start to finish.

All revenues generated from film sales are professionally managed by FilmChain

All revenues generated from film sales are professionally managed by FilmChain, a trusted industry platform specialising in the collection and distribution of film and TV revenues.

Using a secure and transparent online portal, FilmChain ensures that every financial transaction — from global sales to investor returns — is tracked, recorded, and disbursed with precision. Each investor receives personalised access to their own secure dashboard and digital ‘wallet’, allowing them to monitor earnings in real time.

This cutting-edge system provides unmatched transparency, accountability, and peace of mind, ensuring that your investment is managed with the highest levels of integrity and oversight.

Working with exceptional talent and Award winning actors

Matt Barber

Michelle Ryan

Michelle Collins

Anita Dobson

Coline Baker

Tamla Kari

Stephen Berkoff

Mhairi Calvey

Kevin Leslie

Alan Delabie

INVESTOR Q&A

here is a list of the most common questions an investor asks

Curious about film investment? We’ve got you covered.

From:

- What kind of financial returns can investors anticipate and over what time frame?

- How are revenues generated and distributed?

- What is the minimum investment required to participate?

- What’s the current production pipeline like?

… and many more common investor questions.

Click below to explore our Investor FAQs and get the answers you need before stepping into the world of film finance.